If you’re a fan of Family Ties, you probably don’t need convincing that you can learn something about investing in the stock market by watching Alex P. Keaton. Granted, Family Ties was a sitcom and not exactly Wall Street Week, which has been airing on PBS since 1970 and was Alex's favorite show. Still, if you're looking to learn something about how the stock market works (especially if you're interested in margin loans), one of the best Family Ties episodes to watch would be the one called, “Margin of Error.”

"Margin of Error" aired in 1983, and a lot hasn’t changed since then, although the stock market was worth a lot less than it is now. Early in the episode, Alex says to his father, “Hey, Dad, have you been following what's been happening in the stock market lately? I mean, they say that 1,000 is gonna be the base for the future. I mean, can you picture it? A market with a Dow base of 1,000?”

“I grow lightheaded at the very thought,” Steven Keaton says.

The Dow Jones Industrial Average today is (at the time of this writing) hovering around 32,000.

Still, “Margin of Error” holds up pretty well as a lesson on what to do – and not to do – when you’re playing the stock market. Let’s take a look.

Today's "TV Lesson" Breakdown:

- The Plot for “Margin of Error”

- What is buying stocks on margin?

- Why would anyone borrow money from their stockbroker?

- And why would a stockbroker lend an investor money?

- So are you saying that margin loans are risky?

- Do margin loans cost a lot?

- Some fun facts about margin loans

- More About “Margin of Error

- Alex's Commission

- The Risks of a Margin Account

- So what can we learn about playing the stock market from watching Family Ties?

The Plot for “Margin of Error”

While there were plenty of sitcom-esque jokes and plot lines in Family Ties, as you'd expect in a sitcom, and while occasionally the characters would do things that strained credulity, there were often a lot of realistic little moments on the show as well. And “Margin of Error” did an excellent job of keeping the series grounded in reality, albeit with plenty of sitcom hijinks.

The episode begins, and we quickly learn that Alex has a school project in which he gets to pick stocks and track how they’re doing. It’s something that Alex is really gung ho about, but he starts getting frustrated when he realizes that he is, in a sense, losing a fortune. After all, Alex is picking stocks that are really taking off, but he doesn’t have any actual money to invest.

“Look, Dad, I've been making a killing on paper every day,” Alex says. “I mean, I have a knack for picking what's gonna go up and when to get out at a good profit.”

“Alex, charting those stocks is just a school project,” Steven Keaton says.

“I know it's just a school project. That's what's killing me,” Alex says. “Mr. Matthews, down at the brokerage house, he keeps recommending my tips to his clients.”

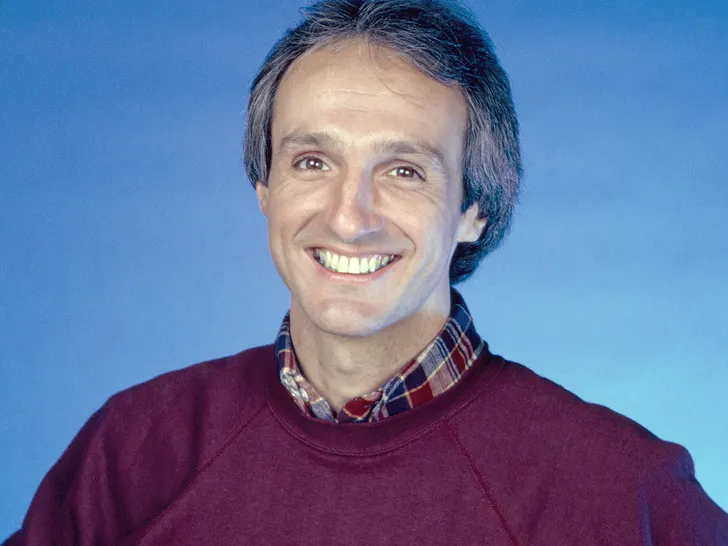

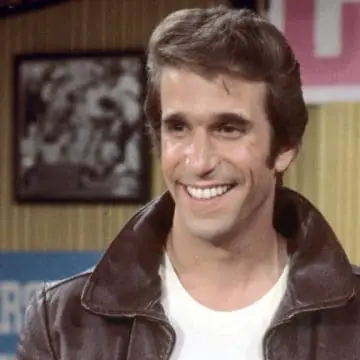

(This is how good of a job Family Ties had done presenting Alex P. Keaton to the audience as a financial prodigy. Just 15 episodes into the first season, we don’t even question that Alex is hanging out at a brokerage house and has befriended a stockbroker.)

Alex tries to get his dad to invest: “Dad, you're missing a golden opportunity here. It's like taking candy from a baby.”

“Brings back memories,” Jennifer says.

And if you’re a fan of the show, even if you haven’t seen this episode, you can probably guess what’s coming. Alex ends up going behind his parents backs and investing some of his parents’ money into a stock, belonging to a (fictional) company called Sykundo Tin. And it doesn’t go well.

But as noted, you really can learn a lot about the stock market in this episode. If you dissect it, that is. I first saw this episode in 1983 when I was 13, and I can guarantee you, I learned nothing about the stock market, other than it can be a great way to earn or lose a lot of money. But if I had been paying attention, I think I could have learned plenty.

So let’s dive into this episode by asking and answering a few questions about buying stocks on margin, which is what Alex ends up doing.

What is buying stocks on margin?

This episode, as noted, is called, “Margin of Error,” and it all centers around buying stocks on margin. Which is pretty remarkable in itself. You don’t find many sitcom plots based on taking out margin loans. (Trust me. I’ve looked.)

If you buy stocks on margin, you’re borrowing money from your broker in order to purchase more stocks than you otherwise would be able to afford. You're allowed to borrow up to 50% of the value of the stocks that you already have in your portfolio. And it should be pointed out that many brokerages don't let you borrow up to 50% of your stock's value. They'll generally allow around 30% to 40%.

The 50% rule was put in place by the Federal Reserve Board called Federal Reserve Board Regulation T (which came about in 1974, nine years before this episode).

Why would anyone borrow money from their stockbroker?

After all, you're investing in stocks to make money and not to go into debt.

True, but maybe you’ve got a really hot tip on a stock, and maybe you don’t have the time or inclination to gather the money you need to buy it, and so you might want to borrow it from your stockbroker. Especially if you are really certain the stock is going to go up in value.

And why would a stockbroker lend an investor money?

Well, it isn’t an issue for the stockbroker. The investor is borrowing up to 50% of the value of their financial portfolio for a reason. The other 50% is the collateral. If the investor is unable to pay back the margin loan, the stock brokerage can use the other half of the portfolio to start selling stocks in order to make the money back that they’re owed.

So are you saying that margin loans are risky?

Heck no – not when you have Alex P. Keaton to steer us through the financial fog. (Well, at least it looks that way at the start of the episode.) But, yeah, for the rest of us mere mortals, margin loans can be risky.

Do margin loans cost a lot?

Not always; sometimes. When you sell the stock at a profit, you’ll pay the stockbroker the money you borrowed – as well as some interest, which is typically less than the interest on a personal loan or credit card, and maybe a fee or commission. Look, it's not a big deal if you make a killing.

But what if you don’t?

Yeah, what if you don’t?

As you’re probably gathering, and as Alex P. Keaton learns in this episode, it can be risky to use a margin loan to buy stocks.

Some fun facts about margin loans

We’ll get back to Alex’s loan and his predicament in a moment. But to really understand the episode, it might help to first know a few other things about margin loans:

- You technically don’t have to pay back margin loans right away. You could take months to pay it off. But the interest will accrue.

- People have been buying stocks on margin for a long time. In fact, one of the reasons the Great Depression (1929-1941) occurred is because people were allowed to buy stocks putting down as little as 10% of the share’s value and borrowing the rest from the stockbroker. And, well, we know how that turned out.

- You can’t actually take out a margin loan without first having a margin account, which Steven and Elyse Keaton did not have at the beginning of the episode (more on that later), though the episode mentions that they used to have one. In fact, this was a pretty timely episode. "Margin of Error" first aired on February 9, 1983. Later in the year, The New York Times would report that in June, margin accounts climbed by 30,000, and in the last three months of the year, by 80,000. Sure, it’s nice to think that the Family Ties episode caused some of that growth, and maybe it did, but it was really just capturing what was going on in the country at the time.

So, OK, back to discussing Alex buying stocks on margin.

More About “Margin of Error

Alex tries to get his dad invested in the idea of investing, but he doesn't have any luck. Steven Keaton holds firm even though Alex makes it clear that Sykundo Tin is a bargain. “It’s gonna triple at least,” Alex says. “But we have to get in on it now. I told the broker we’d call him at home.”

Steven is adamant -- that isn’t happening. “Alex, you’ve got to understand, the stock market is a-a very complex, unpredictable thing," he says. "My own experience with it has been rather, uh…”

“We lost a bundle,” Elyse helpfully explains.

“It’ll be different this time,” Alex says. “All you have to do is reopen the account. I’ll handle it from there.”

“All the account consists of are the 50 shares of AT&T my father gave us for a wedding present,” Steven says.

“And we’re not going to risk that,” Elyse says.

Steven agrees.

Alex is pretty frustrated. As he tells Elyse, “Mom, it’s now or never. Sykundo Tin is gonna be the next McDonald’s.”

Elyse apparently doesn't go to McDonald's much because she doesn't budge.

Given that Alex thinks Sykundo Tin has the value of the Golden Arches, you can almost see why Alex does what he does. Still, even though he hesitates and almost doesn’t pick up the phone, in this moment, he is a bit of a financial psychopath.

In other words, Alex calls Mr. Matthews, the broker, and pretends to be his father and tells him to buy 100 shares of Sykundo Tin.

It isn’t clear in the episode right away – but later in the episode, Alex indicates that he purchased the shares of Sykundo Tin using his own money. Which may take a little sting out of what he did. Still, for collateral, Alex tells Mr. Matthews that the brokerage can use the Keatons’ shares of AT&T. We don't see it worked out, but we can assume that later, Mr. Matthews contacted the Keaton residence, and that Alex took the call and told him to reopen his parents' margin account.

Alex’s 10-year-old sister Jennifer (Tina Yothers) overhears all of this, and he convinces her to stay quiet and that what he is doing is for their parents’ own good.

“Their anniversary is coming up,” Alex says. “Don't you think they'll be surprised, when I give them a nice, big, sentimental check?”

So Jennifer stays quiet, and before long, Alex is buying more stocks. When Steven Keaton asks Alex how the market is doing, Alex shares everything (except the part that this all involves real money, his parents real money): “Well, starting with 100 shares of Sykundo Tin, I parlayed $500 into $3,000. Then I opened a margin account, and I made 20% return in three days. Then I bought options on a South American oil well, made more than triple value in three weeks, and put everything I have... $10,800... into V.I.P. I'm heavily margined, but there's double the chance for profit.”

“That's very nice,” Steven says. “I forgot what I asked you.”

So let’s dissect that a little. A 20% return is astonishing, although not unrealistic. Warren Buffett, for instance, routinely makes 20% a year on the stock market, and clearly, Alex (eventually) is on the path to becoming something similar to the tycoon known as the Oracle of Omaha. As for Alex's South American oil well, Venezuela and Brazil are big oil producers, especially Venezuela, and so it seems likely that's where Alex's oil well was.

Elyse asks what V.I.P. stands for, and that’s when we learn that it’s Video Industries of the Philippines. That becomes important in a little while.

But for the time being, Alex is thrilled with his stock market prowess. He later says to his little sister, “Jennifer, I’ve turned $500 into $10,000. I can’t believe how hot I am!”

“How much is my cut so far?” Jennifer asks.

“One thousand dollars for your college fund, and $50 for a new bike,” Alex says.

Alex's Commission

Yes, let's discuss Alex's commission for a moment. So Jennifer is getting something for staying quiet. You can't help but wonder what cut Alex is planning on taking.

He was probably planning something far more than the standard 1% to 2% of the client’s assets, which is somewhat fair, maybe, since he apparently started off with his own money and he used his smarts and knowhow to make so much money.

On the other hand, he used his father’s name and his parents’ margin account and stock as collateral. The teenage Alex would disagree, but somebody could probably make the argument that instead of a commission, he should be behind prison bars or picking up trash on the side of a freeway as part of some community service. But, yeah, that's kind of dark for Family Ties. The grounding that Steven Keaton puts on him later was probably for the best.

The Risks of a Margin Account

So the pros of a margin account are hopefully clear: a margin account allows you to take out a margin loan, so you can leverage your assets and borrow more than you can afford, so you can make more money than you otherwise would have.

The big negative is that you also might lose more than you can afford. You might lose big.

Alex learns that when he shows up at the brokerage firm, although it’s not clear to him right away that things have gone south. Alex and Mr. Matthews discuss some of the stocks of Alex’s that are doing really well.

“You’re as hot a pistol, Alex,” Mr. Matthews says. “You’ve got the Midas touch.”

“Well, I’m glad I talked my dad into investing,” Alex says.

“Oh, and that setback with V.I.P., while regrettable, is certainly understandable,” Mr. Matthews says.

It takes a moment for things to sink in but after it does, Alex says, looking flustered: “Excuse me. What setback with V.I.P.?”

Well, as Mr. Matthews explains, it turns out that there was a typhoon in the Philippines, and Manilla was hit especially hard, with millions of dollars in damage, and the V.I.P. stock dropped 28 points. Steven Keaton, er, Alex, bought it at 29 points. The stock is now worth next to nothing, and to avoid having the AT&T stock sold, $2,700 needs to be deposited into the margin account by 4 p.m. the next day.

This is pretty realistic. Generally, if a margin call is issued by the broker, the investor has two to five days to meet it.

Right about now, Steven and Elyse drop by the brokerage firm – Alex was going to surprise them for their anniversary and tell them how much money they made. Instead, he comes up with a different excuse as to why he brought them to the brokerage firm and gets his parents out of there as quickly as possible.

For the rest of the day and throughout the next day as the 4 p.m. deadline looms over him, Alex tries to come up with a way to raise $2,700. And, of course, he can’t.

Eventually Alex has to come clean: “I kind of called the broker, and I kind of told him that I was... you," Alex says, looking at his father while also dropping the bombshell to his mother. "And I kind of bought some stock with my money. I was going great, so I bought some more stock... And some more... And I was heavily margined. Well, there's a margin call, and if I don't have $2,700 by 4 o'clock, they're gonna sell your AT&T stock.”

“Alex, let me get this straight,” Steven says, as he processes this. “You lied to us! You went behind our backs! You pretended you were me, and you spent money that wasn't yours!”

“You make it sound so bad,” Alex says.

So what can we learn about playing the stock market from watching Family Ties?

I think lots. For starters, probably the best investing strategy is to try and find a happy medium between Steven and Elyse Keaton’s careful investing approach – invest in something stable and with a great reputation and then be content to let the value of those stocks grow – and Alex P. Keaton’s not so careful approach, which is to try a bit of everything.

The TV Professor isn’t a financial advisor, and so if you are going to inexplicably follow advice from this blog, take Steven and Elyse Keaton’s safe investing approach – buy some stock in a big, safe company and plan to hold it for a long while.

But Alex wasn't entirely off base. People do invest in the stock market, and there’s nothing inherently wrong with taking some chances, if you can afford to lose what you invest. Of course, Alex was investing either mostly or completely with his parents’ money, and so he was really taking a lot of chances. When you play the stock market that way, it isn’t investing. It’s gambling. And Alex lost.

Steven and Elyse lost, too, of course. Near the end of the episode, before Steven and Elyse rush out the door to drive over to the brokerage, he grumbles that he’ll now have to fork over $2,700 to keep his AT&T stock.

“I am the major investor in an underwater video company in the Philippines,” Steven seethes. “They probably have a picture of me in one of their huts with the caption, ‘Our Founder.’”

As for Alex's punishment, he is grounded for the next six months and won't be watching TV.

"Not even Wall Street Week?" Alex asks.

"Especially not Wall Street Week," Steven says.

"C'mon, Dad. I didn't kill a guy."

Of course, in the next several episodes, we see Alex going about living his life. He probably negotiated something with his dad.

So if you ever think about taking out a margin loan with your stockbroker, it may or may not be a fine idea. But you’d probably be far better off not investing in the next hot trend -- and instead putting your money into something that’s stable if unexciting, like AT&T. It's a slow way to get rich, but it's a money-making strategy that may keep you from becoming the owner a water-logged video company.

Where to watch Family Ties (at the time of this writing): ParamountPlus has the entire series. Subscription required for that, but you could go to PlutoTV, which has a 24-hour Family Ties channel in the "classic TV" section (it's free; there are ads).

Articles similar to this Family Ties article: Well, The TV Professor has looked at Family Ties a couple times before, like this one on nailing the job interview, but if you keep wanting to learn about playing the stock market through TV, check out this look at what Car 54, Where Are You? can teach all of us about investing in stocks.

Leave a Reply